The buy low, sell high strategy is effective when used correctly and goes against what most people would do. Investors then sell their stocks at a higher price when others start buying more stocks. Investors that buy low and sell high may be doing so to increase their profits. If the stock price rises, a day trader might buy shares of stock in the morning and sell them at a higher price per share in the afternoon.

Note that these brokers still earn money from your trades, but by selling order flow to financial firms and loaning your stock to short-sellers. There are many advantages of selling shares based on shorter-term technical levels. The disadvantage of this approach is that you’ll likely have to actively manage your trades, whereas longer-term investors are able to utilise a “set-and-forget” approach. Just like buying stocks, selling stocks is a constituent part of a well-managed portfolio. Investors who buy stocks will eventually need to sell them at some point in the future unless they’re income-driven or want to hold the investment until their retirement.

Cardmarket, the peer-to-peer online marketplace that allows Buying/Selling trading card products in an easy way.

As you can see, the 50-day moving average has risen above the 200-day moving average, which indicates that stocks are more inclined to increase in value if you buy now. If you’re an income-driven investor, you may want to hold your investment for a longer period of time. The S&P 500 stock index has been rising for the most part of the last 100 years, and the following table shows its performance from 1998 to 2017.

What is the “Heiken Ashi Algo Oscillator”

It is an indicator that measures volume and momentum. It includes seven different types of moving averages against the relative strength index. Each one of these moving averages calculates faster than the previous, starting from the SMA to the LSMA. Most people, especially beginners, would fall into this category in terms of the type of broker whom they require. They will look at factors such as marital status, lifestyle, personality, risk tolerance, age (time horizon), income, assets, debts, and more. By getting to know as much about you as they can, these full-service brokers can then help you develop a long-term financial plan.

What Is a Limit Order?

This code shows expected reaction target prices after sudden moving based on MFI . Red area means the price is on overbought area, green area means the price is on oversold area. If you see red area under price, you can make short option to next to the horizontal beginning price of red area.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- When potential news or info suggests that an asset may produce more future cash flows, this is the “rumor.” The asset is rumored to be worth more in the next few weeks or months.

- Perhaps there’s a rumor that a company is expected to provide more revenue to shareholders than previously thought.

- There is no universal answer to this question and the perfect time varies from trader to trader and their personal trading goals.

Cardmarket, the peer-to-peer online marketplace that allows Buying/Selling trading card products in an easy way. Please note that tixee.com does not provide services to residents of the European Union. The same goes for those who buy antiques at garage sales for a few dollars and then sell them online for hundreds or even thousands of dollars. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

How to Buy and Sell Stocks for Your Account

Online (discount) brokers do offer investment-related links, research, and resources that can be useful. To buy stocks, you’ll typically need the assistance of a stockbroker, since you cannot simply call up a stock exchange and ask to buy stocks directly. When you use a stockbroker, whether a human being or an online platform, you can choose the investment that you wish to buy or sell and how the trade should be handled. The GBP/USD pair is among the most liquid currency pairs in forex trading.

One of the best ways to avoid that fate is to hold out for a price trend reversal after a good news event. It can be more to your advantage to wait for a brief reversal in price direction and buy at a better price. If there’s a rumor among traders about an upcoming news event, chances are that the market has already moved in the direction of the new or the information is already “priced-in”. If that’s the case, the market may not move as much as expected when the news is finally made official and the trader employing the strategy may not make as much of a profit. The buy low, sell high trading strategy can be complex as you can never predict when a stock price will reach its high or low.

Buying Stocks With a Full-Service Broker

This is a Simple Indicator which shows buy and sell signals based on MACD and SSL channel. So don’t use this indicator to place trades based on signals given by the indicator. Use this as a confluence along with your technical analysis

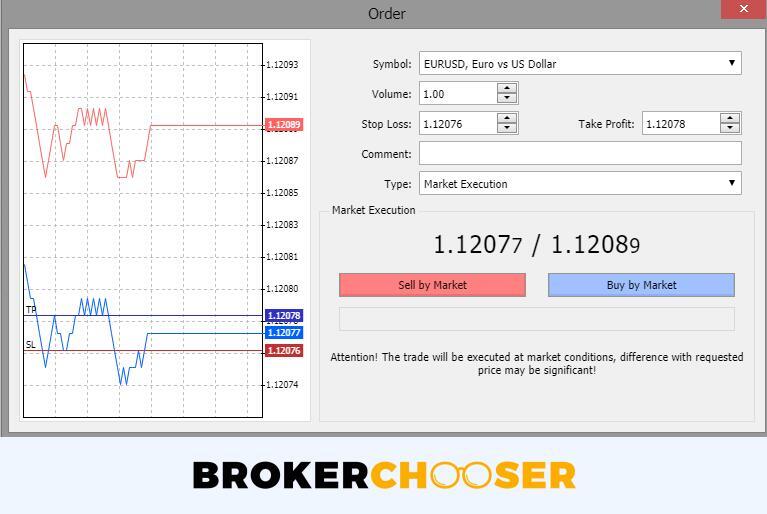

On lower timeframes… 1) Market orders – A sell market order is used if you want to sell your investments at the current market prices. When using market orders, you need to be aware of a potential slippage and widening spreads between the buying and selling prices.